Well, recent media reports indicate that not only does the global wine industry have an excess pool, it has an excess lake. The way we are going, it will soon be an excess ocean. These metaphors seem quite apt. Clearly, the wine industry has an over–supply problem. What is to be done about it, and what is being done?

It is ironic that a decade ago we were commenting on a lack of grapes (eg. April 2012): Winegrape shortage could last six to eight years:

After nearly 10 years of oversupply and low prices, California winegrapes and bulk wines are suddenly in a position of scarcity. Wineries are scurrying to find grapes and secure vineyard assets, while negociant wineries see their wine sources dwindling.Well, that decade has now well and truly passed. These days, we are now getting headlines like these examples, instead:

It’s the million-litre question. what should happen to Australia’s excess wine?

Is anyone interested in buying a million litres of 2021 and 2022 Australian Shiraz, Cabernet and Merlot? It tastes OK, apparently, and could be yours for just US$0.20 a litre. [However,] wine is not water, or milk or Coca Cola or even beer. Producing even the most basic red or white is harder and more susceptible to the changing climate. Selling it cheaply does little to convey that truth to the people who buy it. Instead of trying to get $200,000 for those tankfuls of excess wine, the Australian government would do better to follow the European model of funding its distillation.DOC Rioja recommends moratorium on new vine planting

There are various reasons for these measures but the main driving force is the massive quantities of excess, unsold wine that has been accumulating since 2018. While there have been no absolute, official figures on the complete total, various people within the wine trade in Rioja have stated unverifiable figures that range from 100—150 million liters. This money has formed the base of a plan during the summer that was launched to distill excess wine, paying 0.86€/l for up to 17.5 million liters from 113 approved. Apparently some wineries had too much wine to qualify. Additionally, over 83kg million of grapes were to be purchased by the state to offset excesses from the harvest directly.Note the two quite different payment prices in those two quotations. [Rioja gets >4 times the Australian amount!]

Struggling French winemakers may have to destroy their vintage cellars to survive

According to the local farmers' association, a fall in demand for wine has led to overproduction, a sharp fall in prices and major financial difficulties for up to one in three wine makers in the Bordeaux region. An initial European Union fund, capped at €160 million for wine destruction has been increased to €200 million by the French government.French wine growers destroy gallons of Spanish cava in 'economic war'

French winegrowers hijacked lorries entering from Spain and dumped thousands of bottles of rosé and cava into the road to protest against what they claim is unfair competition. The French vintners said they were protesting against the unfairly low prices of foreign wine that they cannot match, leading to difficulties in selling their own products. Thousands of gallons of rosé were emptied into the street and 10,000 bottles of sparkling Spanish wine were smashed.Global oversupply expected to continue despite below average harvest in 2023

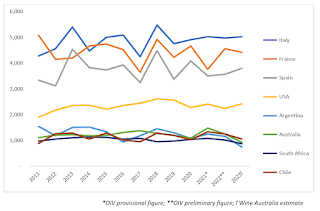

Early estimates indicate that global wine production in 2023 will be below average for the fifth year in a row; however, it is still expected to exceed demand by around 10 per cent, as wine consumption continues its long-term decline.Well, doesn’t that say it all? If you haven’t got the global message by now, then you probably never will get it. Look at the next graph. In most countries, production is not increasing, so that over-supply must logically involve decreasing consumption. Unless we can increase consumption, then we must also decrease production, unless we are to continue looking like idiots. If you can’t sell all of your product, then stop producing so much of it!

Indeed, the above sorts of headlines have been coming for quite some time. Even back in 2020 there was talk of excess grapes:

American wine report warns of over-supply and under-consumption

Rob McMillan in his Silicon Valley Bank 2020 State of the Wine Industry Report: “This oversupply, coupled with eroding consumer demand, can only lead to discounting of finished wine, bulk wine and grapes. U.S. wine consumers will discover unprecedented retail value in 2020 and should buy up.”Wine prices slated to dwindle over excess grape supply, experts say

The price of wine is slated to drop this year due to an excess supply of grapes, ultimately giving wine connoisseurs something to raise a glass to.And previously in 2021:

Wine makers see 'oversupply' as industry brave wildfires, water shortage

It is not immediately obvious to me that there has been any concerted response to these warnings. This is, of course, why we now stand where we do. Indeed, the French Agriculture Minister (Marc Fesneau) has said that the wine industry needs to “look to the future, think about consumer changes ... and adapt” (France’s destruction of surplus wine hints at an existential wine crisis). Quite why the British keep increasing their grape plantings is therefore not immediately obvious (Vineyards become the fastest growing crop in England).

This raises the obvious question: When did the over-supply (ie. over-planting) start? Well, I showed in an earlier post (using a graph) that global wine production has exceeded global consumption since way back in the early 1960s (The smallest global wine production for 55 years?). So, none of this is recent news.

As a final aside, this situation may seem to be somewhat similar to the recent drop in sales of new electric vehicles (Are EV sales declining? Electrifying the car market may be getting harder; Why EVs are piling up at dealerships in the U.S.). In this case, it is reported that we have saturated the current market for pure electric vehicles (as opposed to hybrids), and so sales of new ones have slowed down notably. However, in the case of the wine industry it is, instead, the fact that the marketplace has moved on (to other drink preferences) that has caused the slowdown in sales, not market saturation.

Two points:

ReplyDeleteFirst, how many members of executive management in the wine industry recognize the economic conditions developing (not only in the wine industry but across the entire CPG space)? You better have a clear understanding of the 1980s and.or managed through it!! If not, you are working from a several decade financial, operational and marketing "paradigm" which was utterly destroyed post pandemic. Just examine, there is HUGE push to DTC....why? Inherently, people are recognizing the amplified gross and net margins (when compared to the distribution channel) as well as the "clogs" in the distribution channel (take a look at the SEC filings of both the end retailers (Albertson's et al) as well as wine enterprises.

Second, if end consumers are in "big trouble" (as most everyone knows) economically....no amount of "discount"ing at the end retailers will develop increased demand when the price of milk and eggs are up 50-100% in a year (ie-people are making purchasing choices toward basics rather than "fun" items like wine).

A great KPI is "storage square footage". What is the growth rate in storage square footage in south Napa over the past decade or so? Anyone who visits the Valley can see it driving up 29....pretty easy....

David, another insightful article – thank you.

ReplyDeleteThe entire wine sector seems to be undergoing deep introspection right now. As I've become more critical of the industry, it's alarming to realize how many of the normalized practices within wine amount to deceptive marketing, even verging on outright fraud. It's shocking that 20-25% of the entire wine trade is fraudulent.

On an interesting note, I observed a close timeline between the First Growth Bordeaux Classification and Pasteur's Germ Theory. While Germ Theory revolutionized science, health, medicine, food, and fermented production, the wine industry, especially since the 1855 government-backed monopoly of the first growths, has seen exponential price increases. With our advanced knowledge and technology, shouldn't we be able to produce quality wine affordably? Why then are first growths treated more like investments with expected ROIs than simply great wines?

Sad to say, the planet seems able to make a lot more wine than the population wants to drink. Even tho most wine is now well grown and well made.

ReplyDelete