The world is full of expensive wines, which are often treated as being more for investment than for consumption. Each year, Wine-Searcher publishes lists of the most expensive from certain regions and of particular alcohol types. As foretold in a previous blog post (The world’s most expensive Australian wines?), I thought that I might now look at the area lists for 2024. This is important, in the sense that the upper price bracket determines the top of the pile.

Each list of 10 wines covers “The Most Expensive Wines on Wine-Searcher” for each of the named regions. The criteria for inclusion over the years have generally been: “a wine must have been produced over five consecutive vintages and have a minimum of 20 different offers in our search engine.” The prices quoted in the lists are their Global Average Retail Price (see: Average wine prices).

There are 2024 lists available for these areas: Argentina, Australia, Bordeaux, Burgundy red and Burgundy white, Champagne, Italy, Napa, New Zealand, Spain, and Uruguay. There were 13 (not 10) wines available from Uruguay, due to equal prices.

These wines are listed in the figure at the bottom of this post, with one row per wine and one column showing the Wine-Searcher GARP price, along with its area (click to enlarge). The wines are sorted from most to least expensive, and their rank order is shown.

These data are summarized in the next figure, which shows the average rank order and the average bottle price for each region. There are clearly massive differences in price between the areas, with a 200-fold stretch from Uruguay up to Red Burgundy. The most expensive wine is: Leroy Musigny Grand Cru (red Burgundy) at $38,267 per bottle. [As an aside, the average US salary in 2024 is $60K.]

The presence of Burgundy at the top of the list is no great surprise, remembering that this only represents the 10 most expensive wines; and the reds being more expensive than the whites is also no great surprise. I doubt that Pinot noir and Chardonnay are intrinsically better grapes than, say, Cabernet sauvignon. However, apparently Vivino users did once rate Pinot noir as being better than Cabernet sauvignon, overall (Cabernet sauvignon versus Pinot noir: which is better?).

Nor is it any surprise that Champagne comes next in the list, with its expensive vintage cuvées, and especially as the grapes are again Pinot noir and Chardonnay. These two grape varieties comprised the top 20 wines based on price, before the first Cabernet (see below).

It may, however, surprise a few people that Napa ranks next, ahead of Bordeaux. Napa's 10 most expensive wines certainly do compete globally on price (the wineries have made sure of that). For example, the top Ghost Horse Vineyard Premonition Cabernet Sauvignon ($6,001 per bottle) handsomely out-does both the Petrus (Pomerol, $4,250) and the Le Pin (Pomerol, $3,719).

Italy is slightly ahead of Spain, on average, which out-does Australia. Note that Argentina ranks ahead of New Zealand based on average price, but not on average rank. This is due mainly to one wine: Catena Zapata Estiba Reservada Agrelo, which costs twice as much as the next most expensive Argentinian wine (and thus greatly affects the average price).

It remains to now compare the bottle prices to the assessed wine quality scores (out of 100), as listed by Wine-Searcher. The data are shown in the figure above, with one dot per wine. There are 10 wines that do not have any score provided on Wine-Searcher (and are thus not shown).

There generally is a pattern in the figure, in the sense that the most expensive wines do tend to have the best scores. However, not all of the high-scoring wines necessarily cost the most money. For example, the 97-point wines vary in price from $243 to $20,690, and the 96-point wines vary from $252 to $17,884. Clearly, value for money varies wildly. Interestingly, the only 100-point wine in the list costs an average of just $1,635 — Chateau Angelus Homage to Elisabeth Bouchet (Saint-Émilion). Go for it!

We have been told that these days, wine price is related to increasing score (Weighing wine scores against price), but the data here make it clear that where the wine comes from has a far greater effect on price than its assessed quality.

In terms of the future, there are obvious omissions from the data. For example, Germany, and even the Loire and Alsace, are missing from the regions, which means that Riesling is missing from the grapes. I think that I would have picked these ahead of, say, Uruguay.

Monday, October 28, 2024

Monday, October 21, 2024

There are NO scientific experiments saying: don’t drink alcohol

I do not need to tell most of you about the current problems being faced by the wine industry, and the future sales of wine, particularly in the USA. Back in 1924 the issues facing the newly formed International Wine Office were said to be fraud and Prohibition (The OIV “at a crossroads” in its history). Now 100 years later, with the organization now renamed the International Organisation of Vine & Wine, Prohibition may be returning in the USA, and wine sales are declining worldwide (Is wine facing Prohibition 2.0?).

There are an awful lot of people reacting to this situation, with many of them saying very interesting and valuable things. I will be linking some of these below; but at the same time I am hoping that I can say something of value myself. You see, my professional expertise is in scientific experiments, as I am a (recently retired) university biological scientist. And I mean what I have said in the title above, professionally.

Scientists conduct experiments, which are intended to provide the evidence upon which societal decisions are made. (I used to teach a course on Introduction to Experimental Design, for university biology students.) We use these experiments to study cause-and-effect in a rigorous manner (e.g. the effect of alcohol on people). Most importantly, we know the benefits and limits of experiments; and when it comes to studying the effects of alcohol on people, the latter out-weigh the former. This is what I will be writing about here.

Tom Wark has recently listed 10 of the important recent articles speaking against alcohol, covering all parts of the media: Can the wine industry muster the will to push back on propaganda? I will not be pushing back, but I will instead be pointing out that there shouldn’t be anything to be pushing back against.

I have pointed out in a recent post: Why alcohol experiments are problematic. I will discuss part of this below. Furthermore, I have also asked: Has the WHO lost its way regarding alcohol? Yes, I answered. In particular, I also asked: Has WHO got it wrong with its new zero-alcohol policy? Probably, I said. So, I have not been silent on the issue; and I will continue here.

Let me start by also saying that I do not know what level of alcohol consumption starts to cause medical problems, or whether there is some level below which alcohol actually has benefits (the so-called French Paradox). The purpose of this blog post is to point out that no-one knows, experimentally. This is because it would be impossible / illegal / unethical to do such an experiment, at least in a free society. So, we will probably never know.

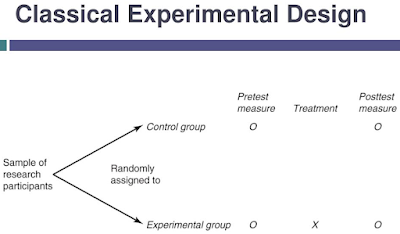

The basic issue is relatively straightforward. The next picture shows you how to do a simple scientific experiment — a single group of people is randomly split into two, one of which gets the “Treatment” (in our case they drink alcohol) and the other is the “Control” (they do not drink any alcohol). If we have done this manipulation properly, then any difference we observe afterwards between the two groups of people must be due to the treatment (Alcohol).

There are also a host of technical requirements, of course, for such a “Manipulative” study. For example, the Control group of people should drink a substitute for alcohol, called a “Placebo”, to make the actions of the two groups of people as similar as possible. Also, the experimenters themselves should be “Blinded”, so that those looking after the experimental people do not know whether any given person is in the Treatment or Control group. We could also have several different groups of Treatment people, of course, with each group drinking a different amount of alcohol. These are all important points, and there are others.

As I noted above, you cannot do this sort of manipulation on real human beings. All you can realistically do is what we call an “Observational” (or “Descriptive”) study, in which we observe a large (see my post: Why do people get hung up about sample size?) group of people, who drink a whole range of different amounts of alcohol. We then try to relate their differences in behaviour to the amount of alcohol they have consumed. We call this an Observational study because all we do is observe the people, rather than manipulate them. I have compared the two types of studies in the next table below (and you can also read about them elsewhere online; e.g. Experiment vs Observational study: similarities & differences).

These Observation studies are not as good as a proper Treatment/Control experiment, but when it is all you have, then needs must. Observational studies cannot reveal cause-and-effect in a rigorous manner, but can merely give us hints. In particular, as I noted in a previous post, we need to be careful about: Misinterpreting statistical averages — we all do it.

As far as the effects of alcohol are concerned, there is at least one well-balanced summary of the current situation regarding the sorts of experiments we have been able to do, by Louis Maximilian Buja (2022): The history, science, and art of wine and the case for health benefits: perspectives of an oenophilic cardiovascular pathologist. *

One of the important points that this author makes is that risk from alcohol does not start at any particular exposure. It is how much alcohol a person chooses to consume continuously that can cause a problem. This makes the World Health Organization current position so problematic: WHO demonizing of alcohol, are their alarms real? The WHO does a disservice to the problem by staking out a radical position.

In addition, we do need to concern ourselves about: How quickly does the alcohol disappear from the body and can you sober up faster? Notably, there are individual differences between people, so any one generalization is hard to make.

This brings us to Dr. Tim Stockwell, a professor in the Department of Psychology at the University of Victoria. He has been described as “the man who is almost single-handedly responsible for convincing the public there is no safe level of drinking.” He has been at it for a couple of decades (e.g. A global phenomenon), and he has made a lot of noise recently; for example: Professor Tim Stockwell versus the J-curve. A good introduction and evaluation is: Moderate drinking and its enemies.

Well, being a university professor does not make you an expert outside the field of your own expertise. Being concerned, as a social psychologist might, about the cultural and personal effects of alcoholism is very laudable; but determining whether alcohol is the cause or the symptom of any perceived social problem is another thing altogether. [His Severity of Alcohol Dependence Questionnaire, for example, is descriptive rather than experimental.]

In particular, given his background, Stockwell’s writing about the elucidation of cause and effect is not written from the perspective of experiments, rather than being written by an observer. Now, this may provide a broader perspective — an outsider can sometimes contribute to conceptual clarity. However, experimenters have an understanding of experiments, how to conduct them, and how to interpret them — these are things that non-experimentalist writers about experiments surprisingly often fail to comprehend.

The main point that I wish to make here is that none of the research publications that Stockwell cites in support of his radical position on alcohol are of the Treatment/Control type, for the reason explained above. They are all of the Observational type, as described above. So, the evidence for his claims is much more limited than he seems to give credit for, as he has no cause-and-effect data.

One publication that I found particularly distressing, as a scientist, was this one: How several hundred lancet co-authors lost a million global alcohol-caused deaths. In it, Tim Stockwell tries to convince us that there has been scientific hanky-panky, in which the data from a first study was manipulated unfairly in a second study. However, what Stockwell does instead is demonstrate his own lack of understanding of science.

You see, the authors of the second study sub-divided the dataset from the first study into coherent sub-groups, and looked at each sub-group separately. This is the sort of thing that you have to do in Observational studies, to deal with the limitations that I discussed above — it is not a Treatment/Control experiment, and so we have to be very careful about interpreting our data. So, the data interpretation in the second study was likely to be much more justified than the data interpretation in the first study, which lumped all of the people into one group.

If you want to read more about these sorts of issues, then these two professional publications are a good place to start:

Conclusion

The bottom line is simple: there never has been, and probably never will be, a proper Manipulative scientific experiment studying the effect of alcohol on humans. It would be unethical and probably illegal to ever conduct such an experiment. All we will ever have is Descriptive studies; and these are hard to set up validly, and they require very careful interpretation.

So, any pronouncement that all effects of alcohol are bad is pure poppy-cock. There are observed benefits and drawbacks, depending on the amount consumed and the circumstances under which it is consumed. That is likely to be as far as we can ever go, as scientists. As Tom Wark recently noted: On alcohol and cancer — be happy, you're gonna be just fine; or as Paracelsus (1493–1541) famously stated: “Whether wine is a nourishment, medicine or poison is a matter of dosage.”

* Here is the author’s Conclusion:

There are an awful lot of people reacting to this situation, with many of them saying very interesting and valuable things. I will be linking some of these below; but at the same time I am hoping that I can say something of value myself. You see, my professional expertise is in scientific experiments, as I am a (recently retired) university biological scientist. And I mean what I have said in the title above, professionally.

Scientists conduct experiments, which are intended to provide the evidence upon which societal decisions are made. (I used to teach a course on Introduction to Experimental Design, for university biology students.) We use these experiments to study cause-and-effect in a rigorous manner (e.g. the effect of alcohol on people). Most importantly, we know the benefits and limits of experiments; and when it comes to studying the effects of alcohol on people, the latter out-weigh the former. This is what I will be writing about here.

Tom Wark has recently listed 10 of the important recent articles speaking against alcohol, covering all parts of the media: Can the wine industry muster the will to push back on propaganda? I will not be pushing back, but I will instead be pointing out that there shouldn’t be anything to be pushing back against.

I have pointed out in a recent post: Why alcohol experiments are problematic. I will discuss part of this below. Furthermore, I have also asked: Has the WHO lost its way regarding alcohol? Yes, I answered. In particular, I also asked: Has WHO got it wrong with its new zero-alcohol policy? Probably, I said. So, I have not been silent on the issue; and I will continue here.

Let me start by also saying that I do not know what level of alcohol consumption starts to cause medical problems, or whether there is some level below which alcohol actually has benefits (the so-called French Paradox). The purpose of this blog post is to point out that no-one knows, experimentally. This is because it would be impossible / illegal / unethical to do such an experiment, at least in a free society. So, we will probably never know.

The basic issue is relatively straightforward. The next picture shows you how to do a simple scientific experiment — a single group of people is randomly split into two, one of which gets the “Treatment” (in our case they drink alcohol) and the other is the “Control” (they do not drink any alcohol). If we have done this manipulation properly, then any difference we observe afterwards between the two groups of people must be due to the treatment (Alcohol).

There are also a host of technical requirements, of course, for such a “Manipulative” study. For example, the Control group of people should drink a substitute for alcohol, called a “Placebo”, to make the actions of the two groups of people as similar as possible. Also, the experimenters themselves should be “Blinded”, so that those looking after the experimental people do not know whether any given person is in the Treatment or Control group. We could also have several different groups of Treatment people, of course, with each group drinking a different amount of alcohol. These are all important points, and there are others.

As I noted above, you cannot do this sort of manipulation on real human beings. All you can realistically do is what we call an “Observational” (or “Descriptive”) study, in which we observe a large (see my post: Why do people get hung up about sample size?) group of people, who drink a whole range of different amounts of alcohol. We then try to relate their differences in behaviour to the amount of alcohol they have consumed. We call this an Observational study because all we do is observe the people, rather than manipulate them. I have compared the two types of studies in the next table below (and you can also read about them elsewhere online; e.g. Experiment vs Observational study: similarities & differences).

These Observation studies are not as good as a proper Treatment/Control experiment, but when it is all you have, then needs must. Observational studies cannot reveal cause-and-effect in a rigorous manner, but can merely give us hints. In particular, as I noted in a previous post, we need to be careful about: Misinterpreting statistical averages — we all do it.

As far as the effects of alcohol are concerned, there is at least one well-balanced summary of the current situation regarding the sorts of experiments we have been able to do, by Louis Maximilian Buja (2022): The history, science, and art of wine and the case for health benefits: perspectives of an oenophilic cardiovascular pathologist. *

One of the important points that this author makes is that risk from alcohol does not start at any particular exposure. It is how much alcohol a person chooses to consume continuously that can cause a problem. This makes the World Health Organization current position so problematic: WHO demonizing of alcohol, are their alarms real? The WHO does a disservice to the problem by staking out a radical position.

In addition, we do need to concern ourselves about: How quickly does the alcohol disappear from the body and can you sober up faster? Notably, there are individual differences between people, so any one generalization is hard to make.

This brings us to Dr. Tim Stockwell, a professor in the Department of Psychology at the University of Victoria. He has been described as “the man who is almost single-handedly responsible for convincing the public there is no safe level of drinking.” He has been at it for a couple of decades (e.g. A global phenomenon), and he has made a lot of noise recently; for example: Professor Tim Stockwell versus the J-curve. A good introduction and evaluation is: Moderate drinking and its enemies.

Well, being a university professor does not make you an expert outside the field of your own expertise. Being concerned, as a social psychologist might, about the cultural and personal effects of alcoholism is very laudable; but determining whether alcohol is the cause or the symptom of any perceived social problem is another thing altogether. [His Severity of Alcohol Dependence Questionnaire, for example, is descriptive rather than experimental.]

In particular, given his background, Stockwell’s writing about the elucidation of cause and effect is not written from the perspective of experiments, rather than being written by an observer. Now, this may provide a broader perspective — an outsider can sometimes contribute to conceptual clarity. However, experimenters have an understanding of experiments, how to conduct them, and how to interpret them — these are things that non-experimentalist writers about experiments surprisingly often fail to comprehend.

The main point that I wish to make here is that none of the research publications that Stockwell cites in support of his radical position on alcohol are of the Treatment/Control type, for the reason explained above. They are all of the Observational type, as described above. So, the evidence for his claims is much more limited than he seems to give credit for, as he has no cause-and-effect data.

One publication that I found particularly distressing, as a scientist, was this one: How several hundred lancet co-authors lost a million global alcohol-caused deaths. In it, Tim Stockwell tries to convince us that there has been scientific hanky-panky, in which the data from a first study was manipulated unfairly in a second study. However, what Stockwell does instead is demonstrate his own lack of understanding of science.

You see, the authors of the second study sub-divided the dataset from the first study into coherent sub-groups, and looked at each sub-group separately. This is the sort of thing that you have to do in Observational studies, to deal with the limitations that I discussed above — it is not a Treatment/Control experiment, and so we have to be very careful about interpreting our data. So, the data interpretation in the second study was likely to be much more justified than the data interpretation in the first study, which lumped all of the people into one group.

If you want to read more about these sorts of issues, then these two professional publications are a good place to start:

- Causal inference about the effects of interventions from observational studies in medical journals

- Observational studies, bad science, and the media.

Conclusion

The bottom line is simple: there never has been, and probably never will be, a proper Manipulative scientific experiment studying the effect of alcohol on humans. It would be unethical and probably illegal to ever conduct such an experiment. All we will ever have is Descriptive studies; and these are hard to set up validly, and they require very careful interpretation.

So, any pronouncement that all effects of alcohol are bad is pure poppy-cock. There are observed benefits and drawbacks, depending on the amount consumed and the circumstances under which it is consumed. That is likely to be as far as we can ever go, as scientists. As Tom Wark recently noted: On alcohol and cancer — be happy, you're gonna be just fine; or as Paracelsus (1493–1541) famously stated: “Whether wine is a nourishment, medicine or poison is a matter of dosage.”

* Here is the author’s Conclusion:

Epidemiological and biological evidence continues to accumulate showing that alcoholic beverages in moderation have a positive effect on cardiovascular health. Some studies give the edge to wine, especially red wine, whereas other studies show favorable benefits for beer and spirits. Despite a lack of consensus on a specific type of beverage, mounting evidence suggests that ethanol and polyphenols within wine can synergistically confer benefits against chronic cardiovascular diseases, mostly ischemic heart disease (IHD). This is particularly true for red wine when consumed as a component of the Mediterranean diet and lifestyle.

Monday, October 14, 2024

The current state of world wine consumption, and our responses to it

We continue to be presented with (quite depressing) news articles and web posts about the current state of the world wine industry, with an observed slump in wine consumption (for example: The post-Covid decline of wines and spirits sales is accelerating). So, it seems to be worthwhile to summarize some of it here, as it is not all bad, at least not globally.

In the USA, of course, there is currently a sea of grapes that exists throughout California for the current vintage, but even that may be only short term, as has been recently suggested (Dan Berger’s Wine Chronicles: The glut); and as was discussed 25 years ago by Lewis Perdue (as presented in the Footnote below). Anyway, here I will look outside of that situation.

There is an observed decrease in wine consumption, as I have covered before (Is the global wine slump almost solely due to China?). Well, The International Wine and Spirits Record has presented us with a list of reasons for this decline (Four reasons for the decline in consumption):

The above graph tells the story. The top three consuming countries are all showing continual declines in recent years (much of it pre-dating the Covid pandemic, which is often cited as a key event). However, the next six countries are all fairly stable. This distinction between the top three and the others is important — the biggest markets dominate the industry, of course, but it is not all gloom and doom.

Sadly, though, this decline is not just in Europe, as last year global wine consumption dropped 2.6% to 221 million hectolitres — the lowest volume recorded since 1996 (see the IWSR reference above). In the USA, wine sales from wholesalers to retail stores, restaurants and bars dropped 8% in the 12 months that ended in August (Wine and spirits struggling in US retail).

The obvious thing to think about, then, is what sorts of responses are possible. One person who has recently offered some suggestions is Lulie Halstead, who founded the research firm Wine Intelligence back in 2002 (Lulie Halstead identifies the opportunities in the beverage alcohol market). Five of her important points include (along with my added comments and links):

To finish off, we might look briefly at wine production, since there is no point in this increasing while consumption is decreasing. The above graph tells the story for the European Union. Production in France and Italy is certainly heading in the same direction as their consumption trends.

Obviously, these top three countries are the largest producers in the world. If we look further, then the top 10 wine-producing countries outside of Europe, as a percent of total production in 2023 were (Top 10 wine-producing countries outside of Europe revealed by Audley Travel):

Footnote: A quarter of a century ago, Lewis Perdue published The Wrath of Grapes: The Coming Wine Industry Shakeout and How to Take Advantage of It (Spike Books / Avon, 1999). He discusses exactly the same sorts of problems that the wine industry is discussing (again) right now. We were reminded of this recently by Mike Veseth (Wine books revisited: Lewis Perdue’s “The Wrath of Grapes”):

In the USA, of course, there is currently a sea of grapes that exists throughout California for the current vintage, but even that may be only short term, as has been recently suggested (Dan Berger’s Wine Chronicles: The glut); and as was discussed 25 years ago by Lewis Perdue (as presented in the Footnote below). Anyway, here I will look outside of that situation.

There is an observed decrease in wine consumption, as I have covered before (Is the global wine slump almost solely due to China?). Well, The International Wine and Spirits Record has presented us with a list of reasons for this decline (Four reasons for the decline in consumption):

- Consumers are increasingly interested in a healthy lifestyle, and are more inclined to socialize without alcohol

- A shift between product categories, and a desire to experiment, especially among Millenials and Gen-Z drinkers (considered to be key demographic groups these days)

- Younger adults generally participate less frequently in wine consumption

- When consumers do drink alcohol, they seek out higher-quality wines (more sophisticated brands and categories), with the emphasis on good value not premiumization (or luxury positioning).

The above graph tells the story. The top three consuming countries are all showing continual declines in recent years (much of it pre-dating the Covid pandemic, which is often cited as a key event). However, the next six countries are all fairly stable. This distinction between the top three and the others is important — the biggest markets dominate the industry, of course, but it is not all gloom and doom.

Sadly, though, this decline is not just in Europe, as last year global wine consumption dropped 2.6% to 221 million hectolitres — the lowest volume recorded since 1996 (see the IWSR reference above). In the USA, wine sales from wholesalers to retail stores, restaurants and bars dropped 8% in the 12 months that ended in August (Wine and spirits struggling in US retail).

The obvious thing to think about, then, is what sorts of responses are possible. One person who has recently offered some suggestions is Lulie Halstead, who founded the research firm Wine Intelligence back in 2002 (Lulie Halstead identifies the opportunities in the beverage alcohol market). Five of her important points include (along with my added comments and links):

- Volume is dropping but value is increasing — a 1% decline in total beverage alcohol consumption in 2023 but a value increase of 3%, with the emphasis on good value, as above (The US wine market faces an unwelcome new normal)

- There is an increase in moderation rather than an increase in abstention; so, people are still drinking wine but just not as much per person (see, for example: Alcohol-free brands urge health minister to update outdated drink labels), and sales of strong wines (ie. fortified wines) have been decreasing for many years (Is there a future for fortified wine?)

- Distinctiveness is the key driver of brand growth, not differentiation — the former concerns making the brand easy to identify, while the latter concerns the different features of a product (one example: Alsace wines stripped back to just ’Gewurz’)

- Diversity is critical for success — there is a growing desire for refreshing styles, rather than focusing on one product, so that adaptability is the name of the game (as one example: A new dawn beckons for the Médoc’s white wines), including alternative packaging (bag-in-box, cans, tetrapaks, etc) for superior wines (Premium bag-in-box wine — has its time finally come?)

- Watch what consumers do in real life — this leads to the conclusion that, for example, there are big opportunities for spritz-style wines, at least in the short term, as well as for cocktails-in-a-can (Maturing RTD category poised for sustained growth).

To finish off, we might look briefly at wine production, since there is no point in this increasing while consumption is decreasing. The above graph tells the story for the European Union. Production in France and Italy is certainly heading in the same direction as their consumption trends.

Obviously, these top three countries are the largest producers in the world. If we look further, then the top 10 wine-producing countries outside of Europe, as a percent of total production in 2023 were (Top 10 wine-producing countries outside of Europe revealed by Audley Travel):

- United States – 9.2%

- Chile – 4.6%

- South Africa – 4.2%

- Australia – 4.1%

- Argentina – 3.7%

- Brazil – 1.50%

- China – 1.30%

- New Zealand – 1.00%

- Georgia – 0.80%

- Mongolia – 0.50%

Footnote: A quarter of a century ago, Lewis Perdue published The Wrath of Grapes: The Coming Wine Industry Shakeout and How to Take Advantage of It (Spike Books / Avon, 1999). He discusses exactly the same sorts of problems that the wine industry is discussing (again) right now. We were reminded of this recently by Mike Veseth (Wine books revisited: Lewis Perdue’s “The Wrath of Grapes”):

The Wrath of Grapes was one of the first books I read when I started studying the wine business. Going back to it now I am impressed with how relevant it remains today and how much it has obviously shaped my thinking about the wine industry.

Although some parts of The Wrath Grapes have naturally aged better than others, the book’s overall argument remains timely and relevant. Most of the big problems that Perdue wanted us to take seriously 25 years ago remain at the top of the agenda. No wonder the book is still in print.So, what comes around once, comes around again. The book is available on Amazon (here and here).

Monday, October 7, 2024

The world’s most expensive Australian wines?

The world is full of expensive wines, which are often treated as more for investment than for consumption. Each year, Wine Searcher publishes lists of them from certain regions and of certain alcohol types. In this post I thought that I might look at some of the lists over the past decade, from one particular wine-producing region: Australia.

Obviously, these wines do not come anywhere near close to the prices of the top Burgundies or Bordeaux wines, but they do represent top wines of a more affordable class for the rest of us.

Each yearly list of 10 wines covers “The World’s Most Expensive Australian Wines on Wine-Searcher”. [Note: only 9 wines were listed for 2014.] The criteria for inclusion over the years have generally been: “a wine must have been produced over five consecutive vintages and have a minimum of 20 different offers in our search engine.”

The lists available to date are for the years: 2014, 2016, 2018, 2021, 2022, 2023, and 2024.

Obviously, the prices have varied greatly over that decade (as discussed below), but this does not obviate a study of which wines made it into the list for each year. These wines are shown in this next figure, with one row per wine and one column per year (click to enlarge).

There are 25 wines in this list, which indicates a fair turnover between years. Indeed, 10 of the wines appeared in only one year each. Furthermore, only one wine made it into all of the lists: Penfold’s Grange Bin 95 (label above). This is no great surprise, as Penfolds deliberately created this wine, in 1951, to be Australia’s best, and it is usually treated as its most collectable wine (see the history in Wikipedia).

You will also note that all 25 of the wines are red, mostly based on the Shiraz grape (18 of them). Australia does make some very nice white wines, as I can personally attest; but apparently the buyers of expensive wines are not prepared to put their money on them. ** Australia also makes some very nice red wines based on grapes other than Shiraz; but this particular grape certainly makes wines unlike those elsewhere in the world — and this is presumably what the investors in expensive wines are looking for.

Similarly, 16 of the wines are specifically from grapes grown in the Barossa Valley, north-east of Adelaide in South Australia. This was originally Australia’s best-known wine-making region, and so this success is perhaps no great surprise — it is a warm region that makes very powerful wines. However, there are many other regions that make equally good wines, but of a completely different style, notably with more elegance than power. McLaren Vale and Eden Valley are both somewhat near Adelaide, and both appear twice in the list of wines. The Clare Valley, Gippsland, and Heathcote are much further away, and each appears once — the latter two are from the state of Victoria, not South Australia. No wines from the state of New South Wales appear on the lists, which state also has some well-known wine-making regions (eg. the Hunter Valley, with Tyrrell’s Vat 1 Sémillon), nor does Western Australia appear.

As far as the wine prices are concerned, obviously they have increased in each yearly list. The average prices of the 10 [or 9] wines in each year are:

2014 $397

2016 $474

2018 $581*

2021 $561

2022 $624

2023 $644

2024 $713

That is, Australia's most expensive wine prices increased by an average of 80% over the decade. Not bad for a financial investment.

It remains only to compare the bottle prices to the assessed wine quality scores (out of 100). We do not expect much of a correlation, and we do indeed not find one. The data are shown in the figure above. ***

The three lowest scores do have the lowest prices, but the highest price has a middling score. Otherwise the data form a blob, with a statistical correlation only = 0.216. As we all suspect, the price of investment-grade wine has little to do with the quality as assessed by ordinary wine drinkers.

As a follow-up to this post, I might do a future post comparing all of the Wine Searcher 2024 lists for different regions and wine styles.

* Minus the Para “port”.

** The label below is from the wine my wife and I had last night with dinner. The 26-year-old wine from the Clare Valley, with its screw cap, has a label that notes: “Red loamy soils over limestone or schist produce wines of great flavour, crisp acid and longevity ... This riesling displays an intense floral bouquet with limey, citrus fruit flavours on the palate and clean crisp finish. It has the pedigree to age gracefully for many years, yet retain its youthful freshness.” All of this was emphatically true. I am so glad that I bought this wine! (It is currently still available in my local liquor store.) The dessert wine to follow was Gramp's 2013 Botrytis Semillon, which was also excellent.

*** The price data have been standardized to allow for the increasing average price across the years.

Obviously, these wines do not come anywhere near close to the prices of the top Burgundies or Bordeaux wines, but they do represent top wines of a more affordable class for the rest of us.

Each yearly list of 10 wines covers “The World’s Most Expensive Australian Wines on Wine-Searcher”. [Note: only 9 wines were listed for 2014.] The criteria for inclusion over the years have generally been: “a wine must have been produced over five consecutive vintages and have a minimum of 20 different offers in our search engine.”

The lists available to date are for the years: 2014, 2016, 2018, 2021, 2022, 2023, and 2024.

Obviously, the prices have varied greatly over that decade (as discussed below), but this does not obviate a study of which wines made it into the list for each year. These wines are shown in this next figure, with one row per wine and one column per year (click to enlarge).

There are 25 wines in this list, which indicates a fair turnover between years. Indeed, 10 of the wines appeared in only one year each. Furthermore, only one wine made it into all of the lists: Penfold’s Grange Bin 95 (label above). This is no great surprise, as Penfolds deliberately created this wine, in 1951, to be Australia’s best, and it is usually treated as its most collectable wine (see the history in Wikipedia).

You will also note that all 25 of the wines are red, mostly based on the Shiraz grape (18 of them). Australia does make some very nice white wines, as I can personally attest; but apparently the buyers of expensive wines are not prepared to put their money on them. ** Australia also makes some very nice red wines based on grapes other than Shiraz; but this particular grape certainly makes wines unlike those elsewhere in the world — and this is presumably what the investors in expensive wines are looking for.

Similarly, 16 of the wines are specifically from grapes grown in the Barossa Valley, north-east of Adelaide in South Australia. This was originally Australia’s best-known wine-making region, and so this success is perhaps no great surprise — it is a warm region that makes very powerful wines. However, there are many other regions that make equally good wines, but of a completely different style, notably with more elegance than power. McLaren Vale and Eden Valley are both somewhat near Adelaide, and both appear twice in the list of wines. The Clare Valley, Gippsland, and Heathcote are much further away, and each appears once — the latter two are from the state of Victoria, not South Australia. No wines from the state of New South Wales appear on the lists, which state also has some well-known wine-making regions (eg. the Hunter Valley, with Tyrrell’s Vat 1 Sémillon), nor does Western Australia appear.

As far as the wine prices are concerned, obviously they have increased in each yearly list. The average prices of the 10 [or 9] wines in each year are:

2014 $397

2016 $474

2018 $581*

2021 $561

2022 $624

2023 $644

2024 $713

That is, Australia's most expensive wine prices increased by an average of 80% over the decade. Not bad for a financial investment.

It remains only to compare the bottle prices to the assessed wine quality scores (out of 100). We do not expect much of a correlation, and we do indeed not find one. The data are shown in the figure above. ***

The three lowest scores do have the lowest prices, but the highest price has a middling score. Otherwise the data form a blob, with a statistical correlation only = 0.216. As we all suspect, the price of investment-grade wine has little to do with the quality as assessed by ordinary wine drinkers.

As a follow-up to this post, I might do a future post comparing all of the Wine Searcher 2024 lists for different regions and wine styles.

* Minus the Para “port”.

** The label below is from the wine my wife and I had last night with dinner. The 26-year-old wine from the Clare Valley, with its screw cap, has a label that notes: “Red loamy soils over limestone or schist produce wines of great flavour, crisp acid and longevity ... This riesling displays an intense floral bouquet with limey, citrus fruit flavours on the palate and clean crisp finish. It has the pedigree to age gracefully for many years, yet retain its youthful freshness.” All of this was emphatically true. I am so glad that I bought this wine! (It is currently still available in my local liquor store.) The dessert wine to follow was Gramp's 2013 Botrytis Semillon, which was also excellent.

*** The price data have been standardized to allow for the increasing average price across the years.

Subscribe to:

Comments (Atom)